operating cash flow ratio ideal

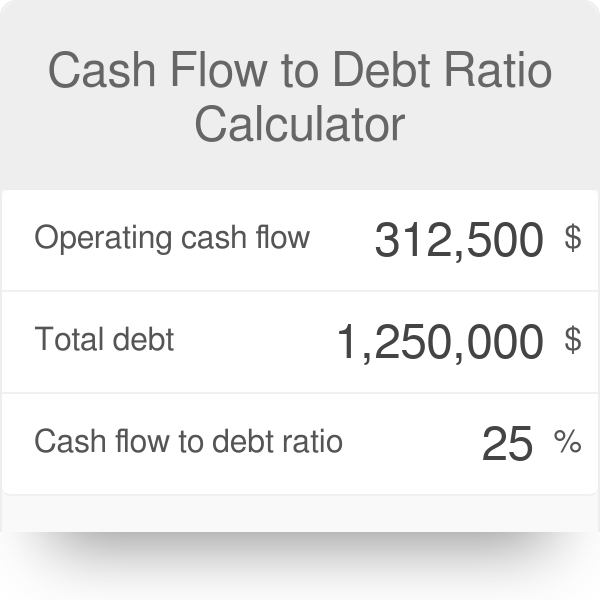

Begin aligned text Cash Flow to Debt frac 312500 1250000 25 25 end aligned Cash. Thus in this case the operating.

How To Create A Cash Flow Chart Easy To Follow Steps

This usually represents the biggest stream of cash that a company.

. The operating cash flow ratio is a measure of a companys liquidity. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula. Calculate the companys cash flow to debt ratio as follows.

Cash Returns on Asset Ratio 5. Similarly current account savings account CASA ratio of bank. This ratio calculates how much cash a business makes from its sales.

Hence with the operating cash flow ratio formula. 500000 100000. Operating cash flow ratio.

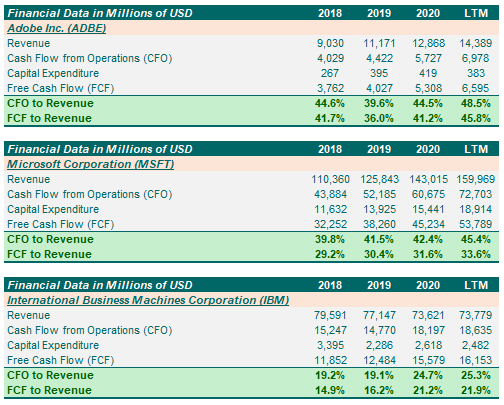

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. A ratio of 11 is considered ideal. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to.

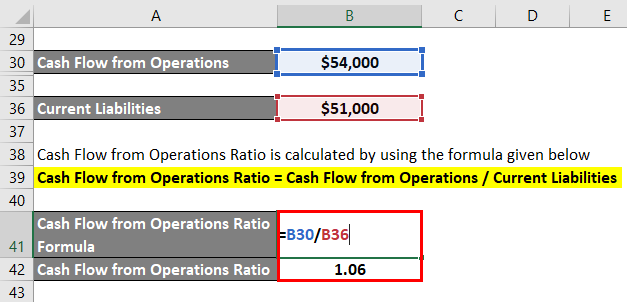

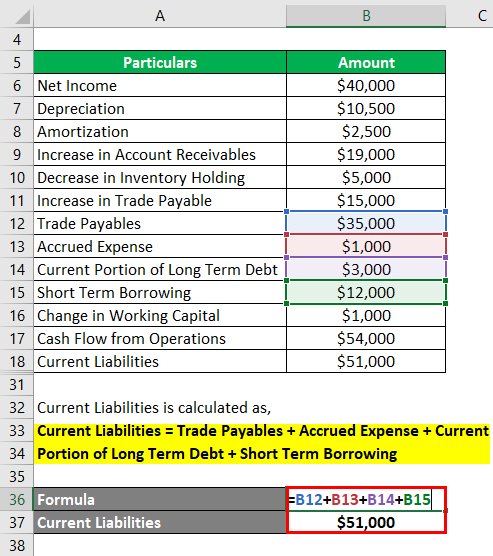

Operating Cash Flow. Operating cash flow ratio CFO Current liabilities. The operating cash flow refers to the cash that a company generates through its core operating activities.

The CAPEX to Operating Cash Ratio is calculated by dividing a companys cash flow from operations by its capital expenditures. OCR Ratio Cash flow from operating activities Current liabilities 872 975 089. The formula to calculate the ratio is as follows.

A preferred operating cash flow number is greater than one because it means a. For instance banks have low operating expense ratios sometimes as little as 0. Since the ratio is lower than 1 it indicates that.

This is because it shows a better ability to cover current liabilities using the money generated. Cash returns on assets cash flow from operations Total assets. It means that the automaker generates a cash flow of 5 on every.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. The Formula for the Price-to-Cash Flow PCF Ratio Is Price to Cash Flow Ratio Share Price Operating Cash Flow per Share textPrice to Cash Flow RatiofractextShare. In general terms an operating cash flow to sales ratio of 10 to 55 is considered good with a higher number indicating a better ability to convert sales directly into cash.

For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time. The figure for operating cash flows can be. This ratio can be calculated from the following formula.

A higher ratio is more desirable. In this case the retail. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

Operating Cash Flow Margin.

8 Cash Flow Ratios Every Investor Must Know

Operating Cash Flow Ratio Finance Reference

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Coverage Ratios Aimcfo

Free Cash Flow Conversion Formula And Calculator Step By Step

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Net Cash Flow Formula Calculator Examples With Excel Template

Price To Cash Flow Ratio Formula Example Calculation Analysis

Steady Cash Flow Is A Challenge Read How To Enhance Business Revenue

Cash Flow To Debt Ratio Calculator

Free Cash Flow Efinancemanagement

Operating Cash Flow Ratio Calculator

What Is A Healthy Cash Flow Ratio Countingup

7 Cash Flow Ratios Every Value Investor Should Know

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Using The Price To Cash Flow To Find Value Screen Of The Week Nasdaq

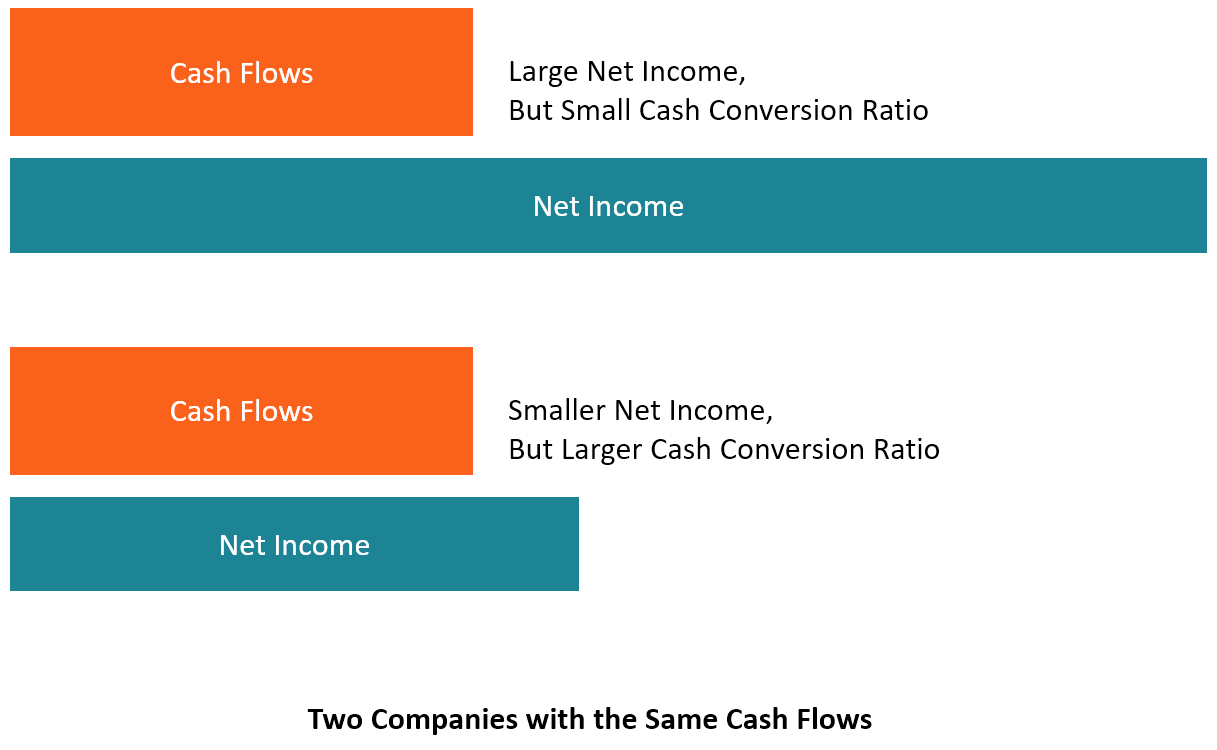

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business