nh meals tax calculator

There is also a 85 tax on car rentals. Multiply this amount by 09 9 and enter the result on Line 2.

Calameo B2g Disposables Catalog

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

. Use this app to split bills when dining with friends or to verify costs of an individual purchase. New Hampshire income tax rate. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

You may be required to file New Hampshire business tax returns if your gross business income exceeds 50000. October 25 2021. Tax Returns Payments to be Filed.

Some schools and students. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets. Designed for mobile and desktop clients.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Please visit GRANITE TAX CONNECT to create or access your existing account. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. The tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. Calculate a simple single sales tax and a total based on the entered tax percentage.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety RSA 261. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshire Paycheck Quick Facts.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Home page to the New Hampshire Department of Revenue Administrations website. Total Price is the final amount paid including sales tax. New Hampshire is one of the few states with no statewide sales tax.

There are however several specific taxes levied on particular services or products. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

TIR 2021-004 2021 Legislative Session in Review. After a few seconds you will be provided with a full breakdown of the tax you are paying. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of.

Meals paid for with food stampscoupons. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Census Bureau Number of cities that have local income taxes.

A 9 tax is also assessed on motor vehicle rentals. Before August 1 2009 the tax rate was 5 Generally food products people commonly think of as groceries are exempt from the sales tax except. The meals tax rate is 625.

Last updated November 27 2020. NHDRA explains how to calculate property taxes as it releases new town tax rates. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

If you need any assistance please contact us at 1-800-870-0285. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Net Price is the tag price or list price before any sales taxes are applied.

New Hampshire Department of Labor 95 Pleasant Street Concord NH 03301 Telephone. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. For more information on motor vehicle fees please contact the.

If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for clarification at 603 230-5030. Be sure to visit our website at revenuenhgovGTC to create your account access today. 8am - 430pm M-F.

A calculator to quickly and easily determine the tip sales tax and other details for a bill. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. 625 of the sales price of the meal.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Fillable PDF Document Number.

Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. 2022 New Hampshire state sales tax.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New Hampshire is one of the few states with no statewide sales tax. For State Use and Local Taxes use State and Local Sales Tax Calculator.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The 2022 state personal income tax brackets are.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served. A 9 tax is also assessed on motor vehicle rentals. Nh meals tax calculator.

603-271-3176 Hours of Operation. Exact tax amount may vary for different items. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

0 5 tax on interest and dividends Median household income. The tax is 625 of the sales price of the meal.

Are Meal Plans Worth It For College Students Student Loan Hero

Producer Food Hub News Food Connects

The Rules On Sales Taxes For Food Takeout And Delivery Cpa Practice Advisor

Coronavirus Stimulus Faq What The New Stimulus Package Will Mean For Food Insecure Americans The Washington Post

Food Order Archives Wilson S Media

Construction Accounting Software Quickbooks Accounting Software Accounting

New Hampshire Sales Tax Rate 2022

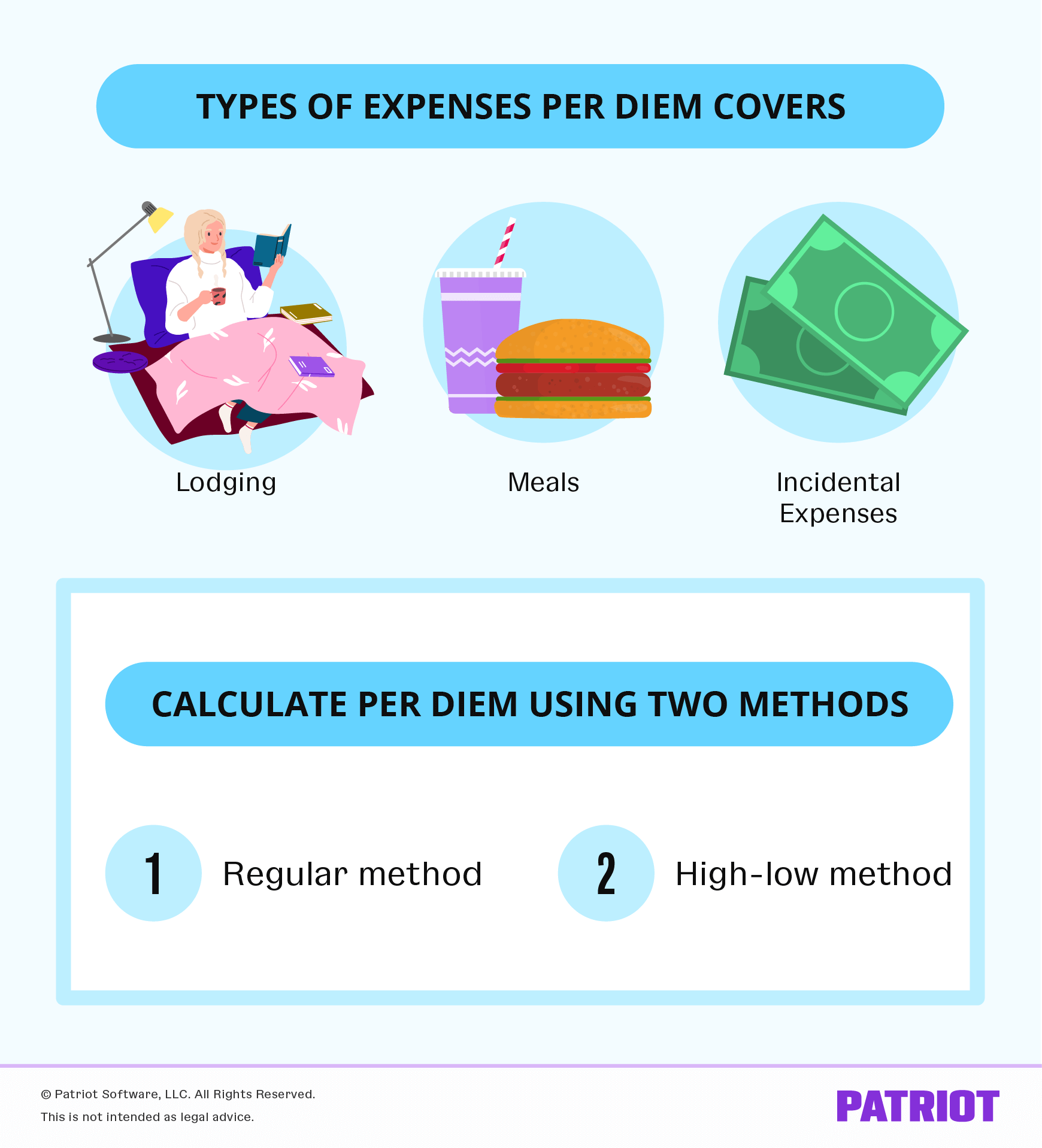

What Is Per Diem Definition Types Of Expenses More

32 Full Hd Standard Signage Display 32sm5j B Lg Us Business

New Hampshire Sales Tax Rate 2022

6 Piece Chicken Mcnuggets Happy Meal Mcdonald S

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Burger King Menu Prices 2022 Fast Food Menu Prices

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Beverly Wilshire Offering Thanksgiving Meals On Nov 25 Travel Agent Central

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Lg 6 3 Cu Ft Smart Wi Fi Enabled Induction Slide In Range With Probake Convection And Easyclean Lse4616bd Lg Usa